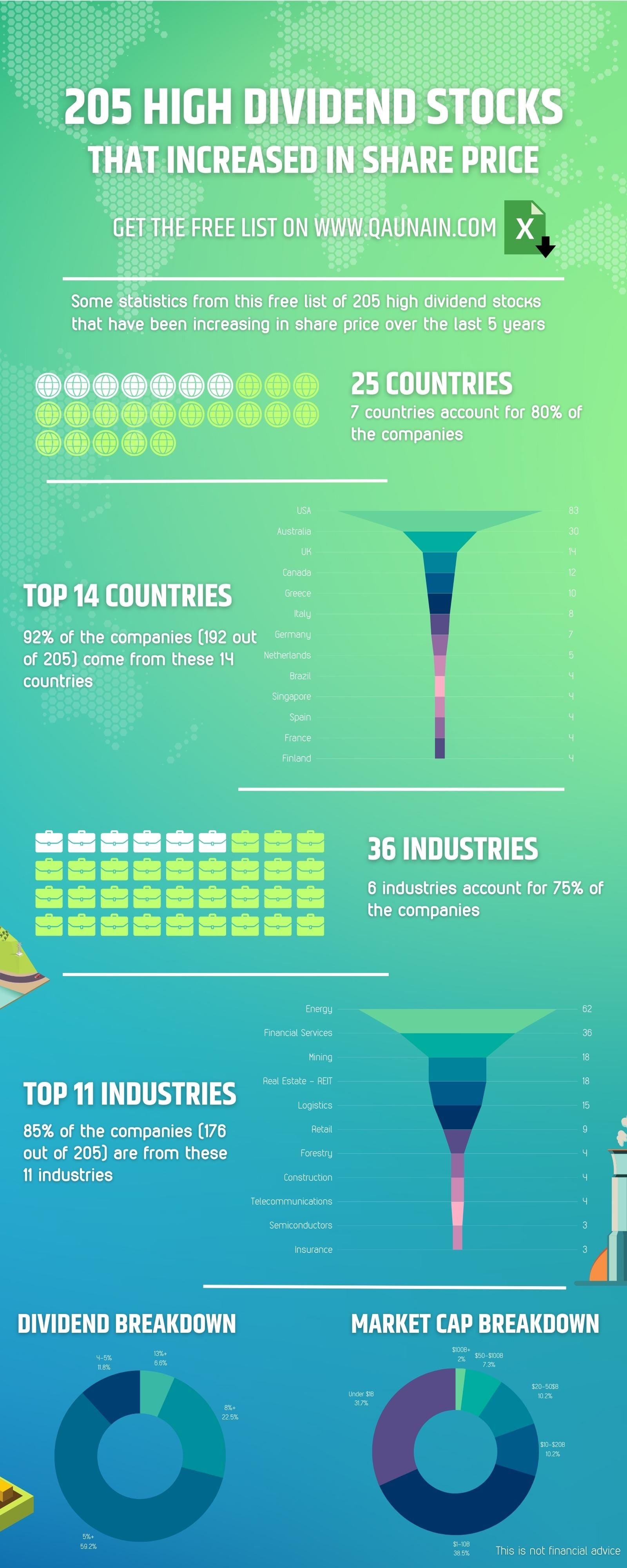

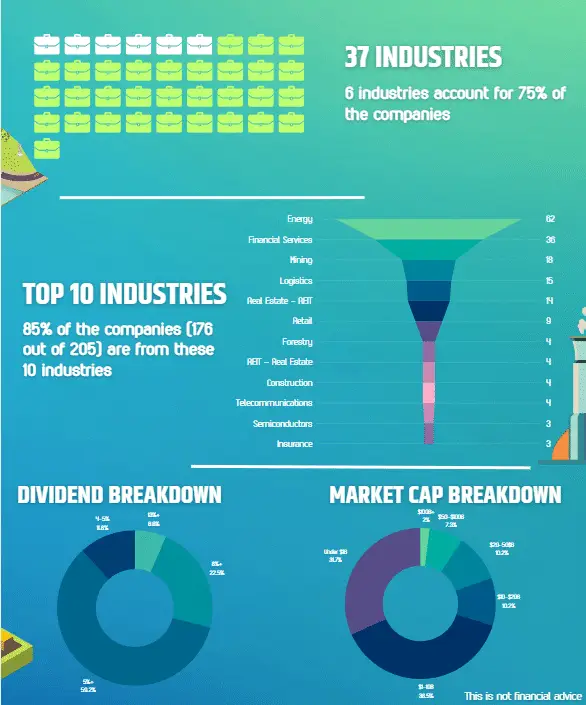

205 High Dividend Stocks – That Increased In Share Price In the last 5 years

I’ve scanned thousands of stocks across global markets and found 205 find companies that give dividend yields of 4%+, which have also increased in stock price value over the last 5 years.

Most stocks don’t give high dividend yields and a large chunk of the ones that do have suffered declining stock prices over the last 5 years, this is why I’ve compiled the list.

– View this list for free in this Google Spreadsheet

– The infographic below shows some high-level statistics from this list, download the image here

Get a full free share if you sign up for Trading212 with this referral link. They have zero fees, zero commission and have a tax free ISA https://www.trading212.com/invite/4KGsyAB

Breakdown

– Dividend Yield = The reward the company pays you for owning the stock. For example, if a stock is $50 and its dividend yield is 10%, you will get $5 every year (normally paid out quarterly)

– Stock Price Increase = A positive change in the public stock price that people buy or sell that stock for

– Fractional Shares = With modern mobile app-based stock brokers you can buy fractions of shares, i.e. £100 can get you fractional ownerships of 100 different stocks.

– Trading212 lets you buy fractional shares and they let you wrap stocks into an ISA (making gains Tax free in the UK), get a full free share if you sign up with this link https://www.trading212.com/invite/4KGsyAB

* This is not financial advice!

- Tags:401kAdvanced Share Registry LimitedAEGON N.V.AllianceBernsteinAllianz SEAnglo American plcAntofagasta plcARC Document SolutionsAres CapitalAtlantica Sustainable InfrastructureAtlas Arteria GroupAxa SABanco Bilbao Vizcaya Argentaria SABanco Latinoamericano de Comercio ExteriorBancroft FundBayerische Motoren Werke AGBCE IncBE Semiconductor Industries NVBHP GroupBig 5 Sporting GoodsBig River Industries LtdBisalloy Steel Group LtdBlack Stone MineralsBlackRock Capital InvestmentblogBNP Paribas SABP Prudhoe Bay Royalty TrustCanadian Imperial Bank of CommerceCanadian Natural Resources LtdCareTrust REITCogent CommunicationscryptoDaimler Truck Holding AGDanaosDelek Logistics PartnersDeutsche Post AGDiana ShippingdividendsDNP Select Income FundDorchester MineralsDorian LPGE.ON SEEagers Automotive LtdEagle Bulk ShippingElisa OyjEmera IncEnbridgeEndesa SAEngie SAEnterprise Products PartnersEnvivaetfetoroEumundi Group LtdEuroseasExxon MobilFidus InvestmentFirst Trust India NIFTY 50 Equal Weight ETFFranchise GroupGaming and Leisure PropertiesGarda Diversified Property FundGenco Shipping & TradingGerdauGetty RealtyGladstone CapitalGladstone InvestmentGlencore PLCGLG Corp Ltd.Global Medical REITGlobal Self StorageGreek Organization of Football PrognosticsGrindrod ShippingGSK plcHELLENiQ ENERGY Holdings SAHercules CapitalHess MidstreamHorizon Technology FinanceHotel Property Investments LtdIcahn EnterprisesImperial Brands PLCInternational Business MachinesISAiShares MSCI Qatar ETFItalgas SpAJ Sainsbury plcKinder MorganLegal & General Group PlcMain Street CapitalMarine Petroleum TrustmarketMedifastMesa Royalty TrustMV Oil TrustMyer Holdings LtdNational Grid plcNatural Resource PartnersNordea Bank AbpNordic American TankerNorth European Oil Royalty TrustNorthwest BancsharesNRW Holdings LimitedNVEOaktree Specialty LendingOmega Healthcare InvestorsOne Liberty PropertiesOneMain Holdings IncONEOK - OKEPangaea Logistics SolutionsPembina Pipeline CorpPermianville Royalty TrustPetróleo Brasileiro S.A. - PetrobrasPhillips 66Poste Italiane SpARepsol SARio Tinto GrouprothSabine Royalty TrustSan Juan Basin Royalty TrustSaratoga Investmentshare priceSibanye StillwaterSisecam ResourcesSnam SpASpirit Realty CapitalSprott Focus TrustSSE PLCSt James's Place PLCStar Bulk CarriersStar GroupStarwood Property TruststocksTotal Energies SEtradingtrading212Trinity CapitalUnited Utilities Group PLCUniversalValmet CorpVanguard International Dividend Appreciation Index FundVOC EnergyTrustVulcan Steel LtdWilliams CompaniesWoodside EnergyGroup LtdZIM Integrated Shipping Services